DEDI, BETS-B and SLEEP - A Swedish Triple Update

Dedicare AB (DEDI)

Dedicare has experienced some major changes since its last quarterly report. After Krister Widström resigned in September, Bård Kristiansen (formerly the CEO of Dedicare Norway) was appointed as his replacement. The weaker market for contracted staff that the company experienced in Q1 and Q2 has persisted, with group net sales declining 12.1% YoY. Even though this is objectively a disappointing number, the significant revenue decline is in line with my expectations. Things will get worse before they get better.

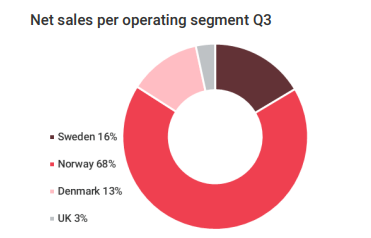

In Q2, Næringslivets Hovedorganisasjon (NHO) claimed that Norway’s healthcare staffing market had contracted 10% due to increased competition and higher price pressures. The blend of this, Norway constituting more than 2/3 of total Group net sales and strong comps, led to a notable decline YoY in terms of both sales and profitability.

Q3 EBITA was SEK 11.2mm (2.43% margin), compared to SEK 40.6mm (7.74% margin) in 3Q23. This was partly due to higher salaries and SEK 7.8mm of non-recurring expenses related to restructuring costs from the savings program (SEK 1.6mm) and the change in CEO and MD (SEK 6.2mm). Excluding these one-offs, Q3 EBITA would have been SEK 19mm, equivalent to a 4.1% EBITA margin (close to 170 bps higher).

The cost savings program initiated in May is expected to have its full impact in Q4 (totaling approximately 15mm), partly offsetting the current adverse operating environment and improving EBITA. Additionally, Dedicare’s renewed 2-year agreement to provide doctors and other healthcare staff in Norway is estimated to generate annual sales of SEK 80-100mm (includes a 2-year extension option), further strengthening top-line visibility.

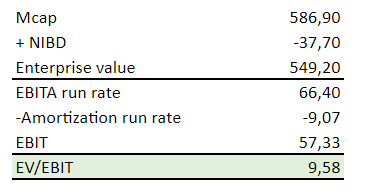

To gauge the current valuation in light of the difficult operating environment, I have annualized EBITA and amortization using run rate figures. The fruition of the investment thesis hinges on the recovery in demand and lower price pressures, but if we assume that the difficult operating environment persists, Dedicare is still trading below 10x EBIT.

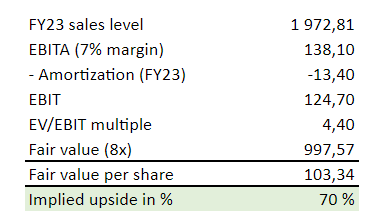

Assuming sales recover to the FY23 level, the EBITA margin reverts to 7% (mid-term profitability target), and multiple expansion to 8x (10-year median), Dedicare’s fair value is north of SEK 100 per share. This could take time depending on the market dynamics within the medical and health care staffing market, but one could also argue that the calculation understates the possible fair value as it does not account for further growth or margin expansion.

Betsson AB (BETS-B)

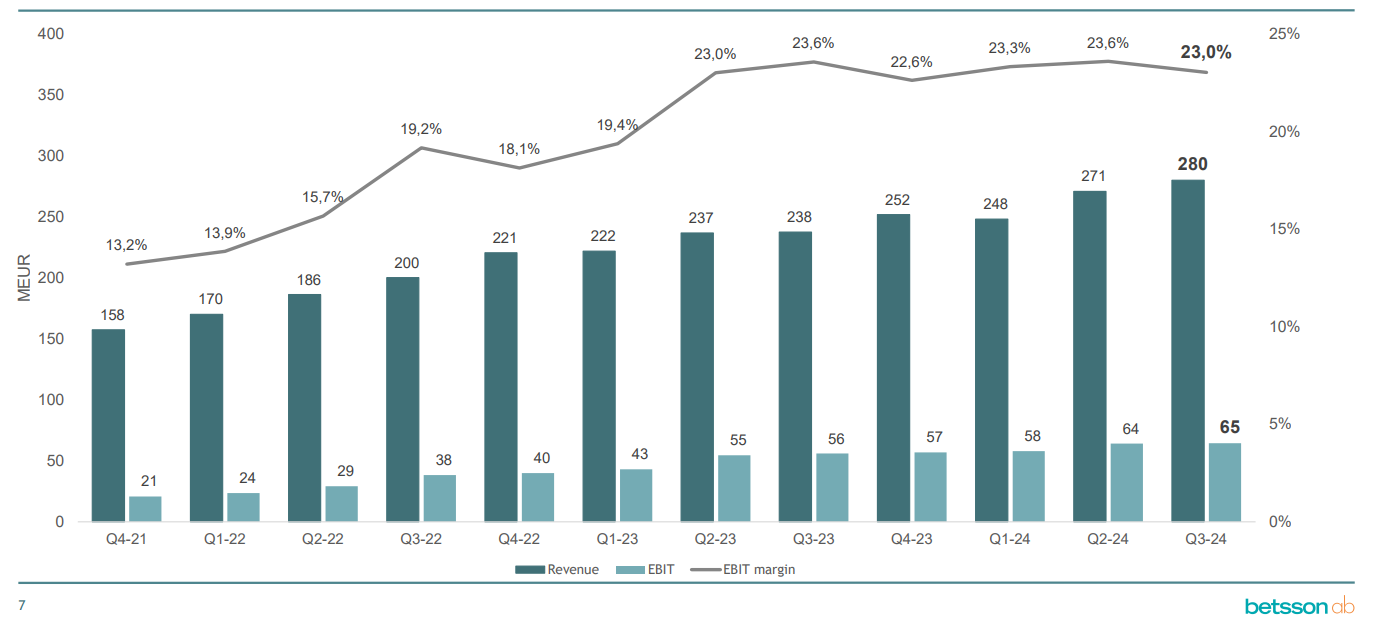

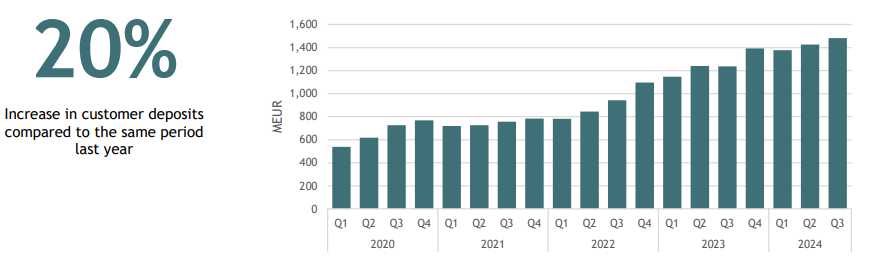

Betsson delivered yet another stellar quarter in Q3, with group revenue and EBIT up 18% and 15%, respectively, YoY. One should note that this is partly attributed to the sporting events European Championship, Copa América, and Paris Summer Olympics.

From Betsson’s 3Q24 Presentation

Still, customer deposits grew impressively QoQ despite the two former competitions beginning in Q2, suggesting that the growth spike is not solely temporary. The Q4 trading update serves as an indication of the ongoing quarter, and with average daily revenue being up 13.9% compared to 4Q24, it suggests that the positive momentum from Q3 continues.

From Betsson’s Q3 interim report

The number of active customers has been quite volatile over the last few quarters, peaking at approximately 1.4mm in 4Q22 and declining QoQ, partly due to difficult comps from Q2 as aforementioned.

From Betsson’s Q3 interim report

Betsson also completed the acquisition of long-time supplier of important betting services, Sporting Solutions, from the French gaming company FDJ for an undisclosed fee in Q3. Since the amount is undisclosed, I am unable to assess how value-accretive the transaction is from a multiple perspective, but the acquisition will contribute with faster and more flexible odds setting, and stronger risk management among other things. Betsson also increased its stake in the JV Betsson France, from 49% to 67%, which means that its financial statements are consolidated as of 3Q24.

Operating cash flow reached €62.5mm for the quarter (39% YoY), equivalent to an OCF run rate of €250mm. Betsson’s balance sheet also remains robust with cash and cash equivalents of €337.5mm, and the refinancing of its initial 22’/25’ bond with a new 3-year floating rate senior unsecured bond of €100mm at 325 bps above EURIBOR, lowering the total borrowing rate.

After several years with highly favorable tax rates, Betsson’s tax bill has had a notable uptick. In Q3, its reported corporate tax was €13.2mm, up from €4.6mm in 3Q23 and equivalent to a 23.2% tax rate. Considering Betsson’s average effective annual tax rate having been below 10% on a 10-, 5- and 3-year basis, this is significant. The higher tax rate is due to a mix of several developments, including an increased tax base in Argentina and Georgia, coupled with the implementation of Pillar 2. The latter forces the company to pay supplementary top-up taxes to cover the difference between its tax rate and the GloBE rules under the OECD’s pillar 2 framework, ensuring a minimum tax rate of 15% in each jurisdiction. It is difficult to predict exactly how high the normalized tax rate will end up being, but Betsson’s period of single-digit corporate tax rates are over for now.

In September, Betsson confirmed its decision to discontinue the B2C operations in Colorado, USA. Pulling its B2C offering is quite disappointing, but the reasoning seems sound. The launch itself was mainly intended to display its sportsbook offering for B2B purposes, and to provide the company with valuable first-hand insights into the US online sports betting market. And who knows, maybe they will relaunch their offering further down the line?

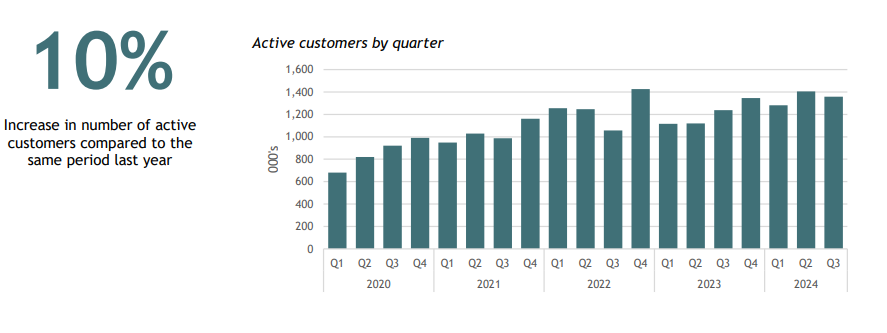

Updating the net cash figure, and revising the estimated tax rate and revenue growth number to reflect the now higher corporate tax rate and U.S. B2C exit, my current fair value estimate is approximately SEK 174 (29% upside) per share.

Although this is not a mouth-watering return, Betsson’s attractive dividend yield (> 5%), and what I consider conservative and achievable assumptions, makes me enticed to keep my position. Additionally, a lower-than-expected annual corporate tax rate would increase the fair value. Hopefully the positive operating momentum continues, coupled with a dividend raise and sustained topline growth through value-accretive and larger sized M&A transactions.

Sleep Cycle AB (SLEEP)

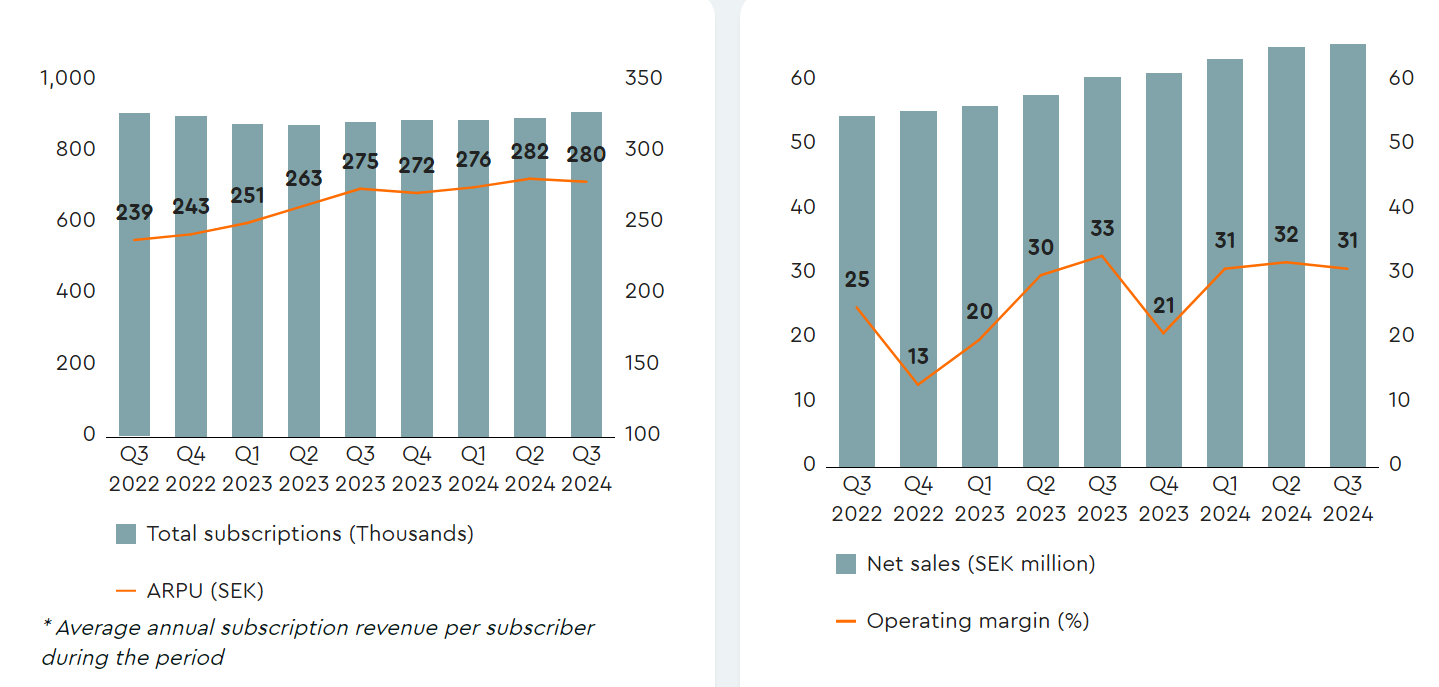

Both revenue and operating income grew YoY for Sleep Cycle in Q3. Although revenue was up only 8.3%, this figure was closer to 10% on a currency-adjusted basis. A somewhat worrying sign was the minuscule increase in operating income compared to 3Q24. A quick look at the P&L shows a SEK 5mm increase in other external expenses, in which SEK 794k and SEK 4.96mm were costs affecting comparability and personnel costs, respectively. The former is defined as a non-recurring item, while the latter relates to the reorganization in 2024. Thus, I think one can reasonably assume that the notable jump YoY will be significantly lower in coming quarters, improving operating income.

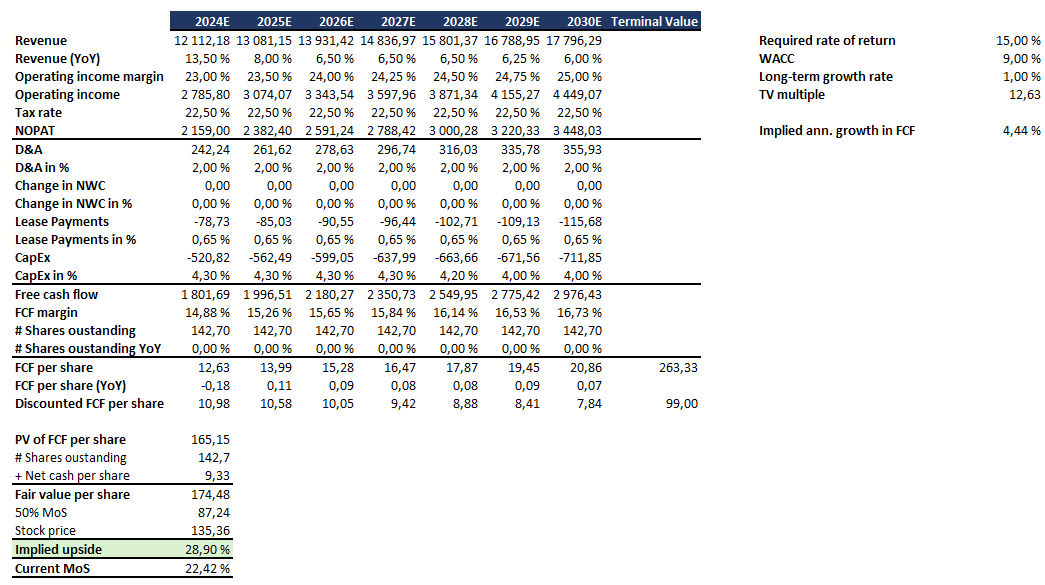

Additionally, both paying subscribers and ARPU increased YoY. The total number of paying subscribers reached 915k (887k in 3Q23), while ARPU for the quarter was SEK 280 (275), and SEK 284 on a currency-adjusted basis.

From Sleep Cycle’s IR page

As can be seen from the above tables, most of Sleep’s revenue growth has been derived from an increase in ARPU. Although the company was able to add 17k net new subscribers in the quarter, retaining customers in light of higher prices requires that the value proposition consistently increases. As such, Sleep is leveraging its vast customer data base to increase the reliability of features and creating better experiences, which in turn drives user engagement. Additionally, Sleep has pivoted towards a much more commercialized model, focusing on customer acquisitions by increasing visibility and brand presence through PR activities, new partnerships and more dynamic pricing. It is important to note that sleep monitoring applications are highly commoditized, resulting in lower differentiation between apps and consequential price pressures.

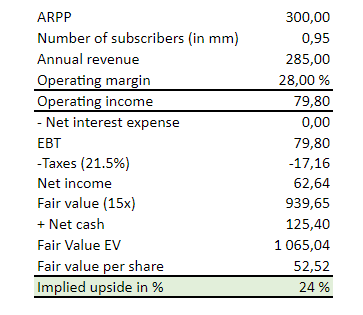

Using the subscriber count and ARPU metrics, we can estimate Sleep’s potential revenue. Assuming ARPU reaches SEK 300, and that Sleep adds 35k net new subscribers (950k in total) through a combination of low price elasticity and customer acquisitions, that equates to annual revenues of SEK 285mm. Pairing this with an operating margin of 28%, Sleep’s operating income could reach close to SEK 80mm. Given the company’s cash-rich balance sheet and practically no interest-bearing debt, the net interest expense should be positive, but I will set it equal to zero here. Using the consensus tax rate of 21.5%, the net income figure is a little north of SEK 60mm. This is only napkin math, but it gives you an idea of where Sleep could trade soon provided the company is able to raise its prices with limited churn.