TKA is a colossal German conglomerate with around 90.000 employees worldwide, and operates within a broad array of industries, including steel, industrial engineering and maritime defense. Despite FCF before M&A totaling €110mn in FY24 and exceeding the company-target, underperforming green technology and a difficult operating environment across the board resulted in negative full-year EBIT and a notable sales decline YoY. While TKA has more than doubled from its bottom in September last year and is up 80%+ from my cost basis, there appears to be further upside through a combination of value-enhancing transactions (e.g., divestitures of low-performing divisions and spinoffs), recovery in its main industries, and improved investor sentiment. So, will the “stock price” tide continue to rise for TKA?

Business Model

Thyssenkrupp AG (TKA) was founded in 1999 through the merger of Thyssen AG and Friedrich Krupp AG Hoesch-Krupp, a period marked by broad steel consolidation. The merger created a industrially diversified powerhouse that today organizes its operations into the following five segments:

Automotive Technology (AT)

Decarbon Technologies (DT)

Materials Services (MX)

Steel Europe (SE)

Marine Systems (MS)

Mid-term adj. EBIT margin target for each reporting segment, from TKA’s 1Q25 Presentation

The AT segment specializes in the development and manufacturing of high-performance components and systems for the automotive industry. Its product offering ranges from steering systems for advanced steering solutions to dampers and axel assemblies. The segment has grown sales from €5.48bn in FY23 to €7.54bn in FY24, and is well positioned to remain an important component supplier as auto electrification and autonomous driving technology continues to grow.

TKA recently formed the DT segment to facilitate advances in sustainable industrial solutions. It currently consists of thyssenKrupp Polysius (eco-friendly cement plant engineering and construction), thyssenKrupp Uhde (chemical engineering tech), thyssenKrupp Rothe Erde (large-diameter bearings and rings), and thyssenKrupp Nucera (tech for green hydrogen production). The latter was spun off and IPO’d in July 2023, and TKA currently holds a 50.19% stake.

MX is TKA’s largest segment by sales and acts as a middleman in the metals and materials supply chain, managing procurement, storage, and distribution, coupled with value-add services. These services include supply chain management, logistics optimization, and digital solutions to enhance efficiency for its customers. It is one of the largest independent materials distributors in the west, covering industries including automotive and aerospace, and delivered sales of €12.13bn in FY24

The SE segment is responsible for the production of high-quality steel, and serves the automotive, industrial machinery, construction and energy industries, offering flat carbon and electrical steel, and tailor-welded blanks. While TKA has already communicated that US tariffs will have a negligible impact on its operations, SE is currently experiencing a difficult operating environment, reflected in the sharp sales decrease from €13.16bn in FY22 to €10.74bn in FY24. CEO, Miguel López, pointed to increasingly slower growth in the automotive industry, engineering and construction as the main reason behind this.

In April 2024, TKA agreed to sell a 20% stake in SE to EP Corporate Group (EPCG). López described the transaction as “a major success and a key milestone on the path to implementing the planned stand-alone solution for the steel business” in his 2024 letter to shareholders, with the mutual aim being to establish a 50/50 JV with EPCG.

TKA’s MS segment specializes in the design and building of naval vessels and submarines. It is the only German system supplier, and provides submarines for defense applications, surface vessels equipped with up-to-date technology, and maritime defense systems for naval operations. With FY24 sales of €2.12bn, it is the smallest segment by sales, but its current record order backlog > €16bn translates to 7+ years of backlog visibility.

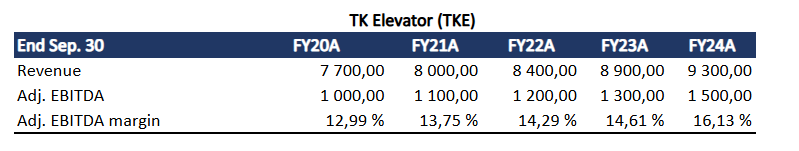

In addition to the aforementioned reporting segments, TKA still owns close to 19% of TK Elevator (TKE) after selling the company to a consortium of Advent, Cinvent, and Germany’s RAG Foundation in July 2020 for €17.2bn. The minority ownership comes from its 18.95% stake in Vertical Topco I S.A., an entity created after the transaction to serve as the parent company of TKE and managing the ownership structure post-acquisition. TKE has trucked on relatively well since the acquisition, growing sales and adjusted EBITDA at 5% and 11% annualized clips, respectively.

Management Compensation and Activist Investors

While the current setup and substantial SOTP and TBV discounts look enticing, a correctly incentivized management team is essential to ensure that the right steps are taken. Looking at TKA’s 23/24 compensation report, the managers currently part of the executive board compensation system are:

Miguel López: CEO of TKA and DT

Dr. Volkmar Dinstuhl: CEO of AT and responsible for M&A → Ordinary Board Member (OBM)

Ilse Henne: CEO of MX and responsible for sustainability → OBM

Dr. Jens Schulte: CFO → OBM

Note that Oliver Burkhard, former CHRO of TKA, stepped down from his position on January 30 this year to focus entirely on his new role as CEO of MS. As such, he is no longer eligible for the executive board compensation, and the change hints to TKA’s plan of spinning off MS and pursue a listing for TKMS.

The executive board members, consisting of the CEO and OBM, receive fixed annual compensations of €1.34mn and €700k, respectively. In addition, they receive fringe benefits (e.g., company car and insurance) and annual pension allowance instead of a company pension plan, of which the CEO receives €536k and the OBMs receive €280k.

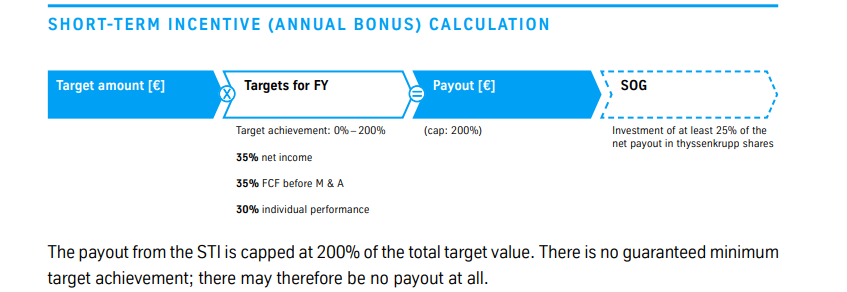

The short-term incentive (STI) bonus is based on net income (35%), FCF before M&A (35%) and individual performance (30%), with payouts ranging from 0%-200% in FY24. For net income, this implied that no STI would be paid out below a €156mn threshold, and was capped at €1.66bn. The CEO had a pre-set base value of €1.25mn in FY24. This implies that if TKA had achieved their target value of €656mn for net income, he would have received €1.25mn*100%*35% = €437.5k, solely based on this target, or double that amount for the 200% cap.

The OBMs had similar structures but with pre-set base values of €510k-€680k. Both the CEO and OBMs also had individual performances as part of their STI bonuses, largely based on the APEX performance program (4%-6% adjusted EBIT margin on group level, cost savings, and transformation and turnaround targets).

Additionally, 25% of the aggregate net payout (STI + LTI) must be reinvested into TKA shares until they have accumulated shares equivalent to one annual fixed gross salary. These shares must be held for the duration of their executive board member tenure, and only the exceeding amount can be sold once the annual fixed gross salary threshold has been reached.

STI plan - From TKA’s 2023/2024 Compensation Report

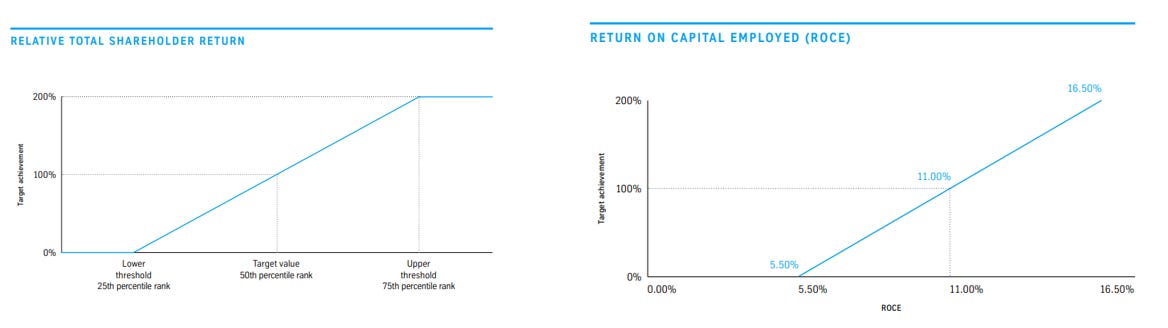

The LTI bonus operates over a four-year period, and involves granting the executive board members virtual shares at the beginning of each performance period. The number of shares are computed as the LTI target amount divided by the average TKA share price over the preceding 30 trading days. The performance criteria are relative total shareholder return against companies in the STOXX® Europe 600 Basic Resources index (30%), return on capital employed (ROCE), weighted at 40%, and sustainability targets set by the supervisory board.

Shareholder return and ROCE targets - From TKA’s 2023/2024 Compensation Report

At the end of each year within the performance period, the supervisory board evaluates the achievement of these performance criteria and adjust the number of virtual shares where they see fit. At the end of the four-year period, the number of virtual shares are multiplied by the average share price over the preceding 30 trading days to compute the total payout.

LTI plan - From TKA’s 2023/2024 Compensation Report

While the fixed annual compensation is rather egregious, especially for European standards, the STI and LTI bonuses seem to heavily incentivize the management team to turn the ship around. The STI bonus tied to net income and FCF before M&A incentivizes management to divest underperforming divisions and cut costs. The LTI criteria of relative total shareholder return, on the other hand, could push management to seek spinoffs and other transactions to crystallize value, and distribute excess cash to increase the dividend yield and remove the discount currently placed on retained cash.

While I have been unable to confirm whether Cevian Capital, the largest activist fund in Europe, still holds TKA shares after slashing its stake to less than 1% in 2022, the current largest shareholders are a mixed bunch.

Share ownership of thyssenkrupp AG - MarketScreener

The Alfried Krupp foundation is effectively forced to hold its 21% stake, except for under exceptional circumstances, and any selling requires approval from the foundation’s board subject to strict conditions.

Out of the remaining funds, only Niche Asset Management Ltd. (UK-based firm that sometimes takes an activist stance) and Ennismore Fund Management Ltd. (more value-oriented hedge fund) seem somewhat likely to push the management team for further value-crystallization. As such, the investment thesis largely hinges on the effectiveness of the current executive board compensation.

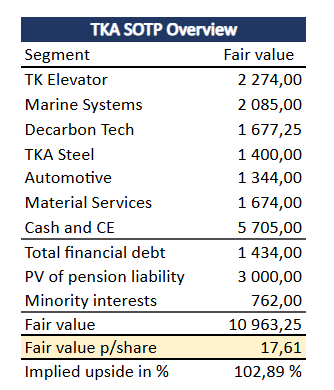

Valuation

TK Elevator

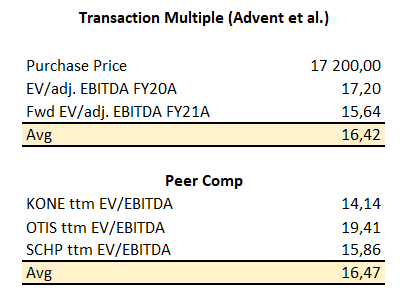

Beginning with TKE, we already know that the 2020 purchase price of €17.2bn translated to a €3.3bn value for TKA’s remaining stake. Based on FY20 and FY21 EBITDA, the valuation at the time was around 17.2x ttm EBITDA and 15.6x forward EBITDA. And TKE’s closest peers, KONE, OTIS and SCHP, currently trade in the range of 14x to 19x ttm EV/EBITDA.

If we simply take the midpoint of the average peer and transaction multiple, TKE should trade at around 16.5x EBITDA. Applying this multiple yields a fair value of around €4.2 p/share or 56% of the current share price.

I am borrowing this insight from Ulf Huse, but TKE also has a €0.9bn loan from TKA. Adding this to the calculation increases the FVPS by an additional €1.45 p/share, suggesting that the FVPS solely based on TKE is around €5.6.

While making this writeup, TKE also announced that Alat, a unit of Saudi Arabia’s sovereign wealth fund, had bought a 15% stake in the company. Though the exact details regarding the purchase price and name of the selling shareholders have not been disclosed, people familiar with the matter have reportedly said that the deal values TKE at €23bn, or around €12bn net of NIBD.

The keen eye might notice that this is 9% below the initial fair value estimate. I will naturally use the low-end for the SOTP calculations, but the high-end gives you an idea of what TKE could arguably be valued at. Further deleveraging, ongoing cost-cutting initiatives and more profitable services growing their share of sales should also contribute to TKE’s intrinsic value growing over time.

Note that the above valuation is without accounting for any of TKE’s five reporting segments. In other words, the TKE stake alone covers 60%-65% of the current market cap.

Marine Systems

In Q1, MS experienced meager increases in sales and EBIT, reaching €568mn and €31mn, respectively, and equivalent to sales and EBIT run rates of €2.3bn and €124m. Still, order intake grew to more than €5.4bn compared to only €529mn in 1Q24 due to a contract agreement reached with the German government for delivery of four submarines valued at €4.7bn.

Management has already expressed interest in turning MS into a stand-alone company through a minority spinoff. While certain analysts believe the transaction should be completed rather quickly to avoid a dampened valuation in light of ongoing peace talks to end the Russia-Ukraine war, several European countries are ramping up their defense spending in light of the US considering withdrawing from NATO. Just this weekend, Ursula von der Leyen, president of the European Commission, urged member states to step up defense investments. This will likely lead to sustained demand for military shipbuilding as companies bolster their military capabilities.

Looking at MS’ most adjacent European peers, both BAE Systems and Fincantieri SpA trade at approximately 19x EBIT. I think a high-teen multiple is quite rich given the capital intensive nature and cyclicality of shipbuilding. If we assume a slightly more reasonable 15x EBIT, that still translates to €3.4 p/share share, and the likely minority spinoff should help crystallize this value, if not enhance it further.

Decarbon Tech

The Decarbon Tech segment is considered a pivotal part of TKA’s long-term strategy. While green tech has generally not delivered on expectations, TKA currently has several different bets on this market. Nucera is rather simple to estimate as it is publicly listed and TKA held a 50.19% stake as of the most recent filing. Although Nucera has had a tough time since its IPO in July 2023, TKA’s stake based on the current market cap equates to around €0.90 per TKA share.

Rothe Erde is more difficult to evaluate, but it generated earnings of €101mn in FY23, a 16% decline YoY. If we assume that it declined at a similar rate in FY24 (potentially too conservative) and back out the 30% corporate tax rate, we can approximate EBIT at around €120mn. In 1Q25, RT outperformed the prior-year figure from an order-intake perspective due to increased demand from the wind sector and accompanying slewing bearings. So while profitability remains a question, there is clear demand and structural tailwinds position RT for further growth.

Valuing RT from a relative valuation perspective, SKF AB and Schaeffler AG are currently trading at an average ttm EV/EBIT multiple of 9.46x. Applying this to RT’s EBIT of €120mn yields a value of €1.82 per TKA share, equivalent to 31% of the current share price.

While Nucera and Rothe Erde collectively equate to a little south of €3 per TKA share, the Decarbon Tech segment also consists of Uhde and Polysius. I have chosen not to include them in the valuation, but if management were to spin them out in the future and they can justify similar valuations, this adds to the upside.

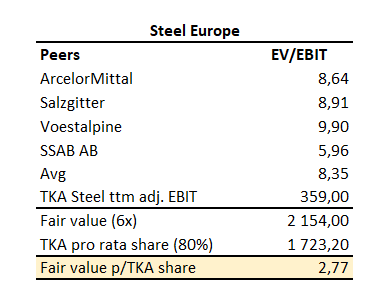

Steel Europe

As I mentioned earlier in the writeup, Steel Europe is arguably the segment that has been hit the hardest in recent time. While TKA has explicitly stated that U.S. tariffs will have a rather insignificant impact on its operations, the steel business is inherently capital intensive and cyclical, and salary expenses have ran rampant with inflation as SE employs around 27k workers. Still, talks of turning SE into a JV with EPCG are currently ongoing. While the specific figure EPCG paid for the 20% stake has not been disclosed, analysts estimated that the purchase price was in the range of €350mn-€400mn. If we use the low-end of this range, the implied EV of SE is €1.75bn. This translates to €1.4bn for TKE or €2.25 p/share.

Alternatively, TKA’s stake could be valued from a peer perspective. Applying the average peer multiple to SE’s ttm EBIT of €359mn translates to a FVPS of €2.77.

Additionally, SE announced plans of reducing its workforce by 40% within 2030. This translates to around 11k workers, and should, with an average cost of €80k per worker, lead to €880mn in cost savings (appr. €170mn p/year). The approximately €2.6bn worth of pension liabilities tied to SE and carried on TKA’s books would also see a noticeable decrease if the JV goes through. If all pension liabilities tied to SE are transferred to the new entity, it will disappear from TKA’s books, while it might be evenly split between TKA and EPCG (appr. €1.3bn each) in the event of it remaining in the parent.

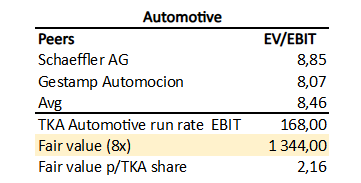

Automotive

With falling new car registrations, volatile fuel prices and governmental push towards use of public transport, European car sales have been in steady decline. One could argue that we are due for a trend reversal, but in the meantime, AT will likely have to soldier through a difficult operating environment. 1Q25 EBIT and adjusted EBIT came in at €-21mn and €12mn, respectively, a far cry from FY24 adj. EBIT of €245mn.

Still, the FY23 adjusted EBIT figure was €266mn, implying that the segment has kept adjusted EBIT in the €245mn-€266mn range over the last two years. And given the difficult operating environment over the last few years, it does not seem too far-fetched to assume that these figures could be close to the bottom EBIT wise (knock on wood). Looking at Schaeffler AG and Gestamp Automocion, they trade at around 8.5x ttm EBIT on average. If we look at the 1Q25 EBIT of €42mn and use the run rate EBIT of €164mn, AT could be worth around €1.35bn at 8x EBIT, or €2.2 p/share.

Material Services

Unlike SE, MX is not exposed to the capital intensity of steel production. Instead, it works as a middleman in the steel and material industry, with value-add services. But despite the more capital light business model, MX is prone to the same macro backdrop. While adjusted EBIT grew from €178mn in FY23 to €204mn in FY24, EBIT told a different story as it decreased to €8mn. While I usually would not even touch adjusted figures with a 10-foot pole, restructuring expenses, impairment losses, and gains and losses from sales under the hood do distort the picture (that does not only apply for the MX segment). Another example would be that hedge accounting on C02 forward contracts have been discontinued since fiscal year 22/23. This results in significant changes in SE’s P&L as fluctuations in the fair value of these contracts are recognized directly in financial results. I consider it reasonable to adjust the EBIT figure to exclude these effects, is it not?

Anyways, when I looked for suitable peers I quickly noted a dichotomy between the multiples the market assigned to these companies and their steel/metal production counterparts.

As can be seen above, MX’s peers trade in the range of 13-17x ttm EBIT. While I would definitely not complain about a take-out offer at similar multiples, I feel that coupling this multiple with the adjusted EBIT figure would be too inflated and unrealistic. Assuming a 50% premium to SE seems more reasonable to factor in the lower capital intensity while also reflecting the current market environment both segments are exposed to. Doing so suggests that MX’s current fair value is close to €1.7bn or €2.7 p/share.

Before synthesizing the individual valuations into a SOTP, we need to understand TKA’s current pension liability. It is carried on the books at €5.75bn, but as Ulf correctly pointed out, that figure is only discounted at €3.3%.

Discount rate on PLs - From TKA’s 1Q25 report

By applying a discount rate of 10%, which is in line with the rate assets are typically discounted at, the present value of the pension liability is closer to €3bn. TKA also has financial debt of around €1.4bn and minority interests of €762mn. Including all of these in the NIBD calculation and subtracting cash and CE of €5.71bn as of 1Q25, equates to a net cash position of €509mn. As shown below, I believe TKA could potentially be worth around €18 p/share based on a realistic SOTP valuation.

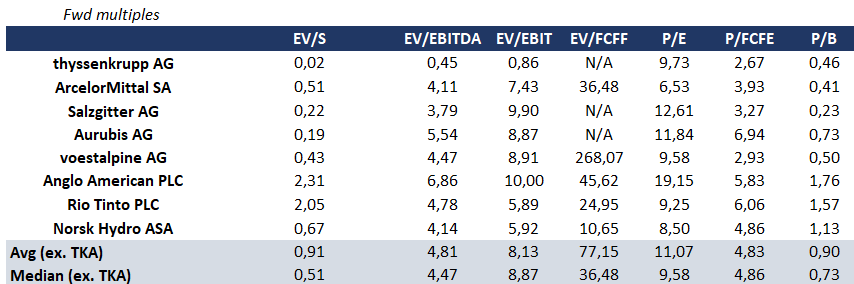

An alternative but very simplified approach would be to use management’s FY25 adjusted EBIT guidance of €600mn-€1bn, comparing TKA to suitable peers (somewhat difficult due to all the moving parts) and discounting those figures back at 10%.

There are several faults with this approach, including unreasonable simplification and dependence on accurate management guidance. Still, it serves to illustrate that TKA looks pretty cheap from an EBIT perspective at a single-digit multiple too ~ with FVPS in the range of €8-€14. Note that the discount to fair value from this approach was much more meaningful when I first started making this writeup - not so much after the recent run-up.

Risk Factors

Value-destructive capital allocation

A risk factor that is absolutely warranted is bad capital allocation as shown by management’s history of reinvesting cash at low returns and returning only a fraction to shareholders. While the current management team seems to be taking the necessary steps to unlock hidden values, only a portion of this value should be reflected in the stock price if management chooses to retain all cash and deploy it into low ROI projects. The DT segment comes to mind. It is currently a money-losing segment and the spinoff of Nucera shows that the market is not receptive to these types of businesses at the moment. While this could change over time, the success of the investment thesis hinges on prudent capital allocation and preferably a significant increase in capital distributions as cash continues to build up on the balance sheet.

Tariffs

Further tariffs and a relatively unpredictable macro environment could pose a threat for the SE and AT segments in particular. While management has said that the current tariffs imposed by the Trump administration are expected to have a small impact on TKA’s operations, North America accounted for more than 20% of the group’s sales in 1Q25. The EU’s carbon tariffs on imported steel could also result in retaliatory tariffs from non-EU countries, negatively impacting SE. And since AT supplies auto parts to global car manufacturers, the segment is especially prone to tariffs from the US and China as it will likely lead to reduced demand for European cars (and consequentially auto parts).

Catalysts

Minority spinoff of MS → “Marine Systems has additional opportunities for growth arising from the increase in global demand in a changing security policy environment. We aim to optimally leverage these opportunities by seeking a stand-alone solution for our naval shipbuilding activities.” - Miguel López

Intended 50/50 JV with EPCG for SE.

Increased dividend could signal that the new management team is more shareholder-friendly.

Closing Words

While I am generally not a fan of investment ideas that depend on SOTP, TKA has shown that it is taking the necessary actions to crystallize these hidden values. In recent time, this has included the finalized sale of Electrical Steel India to JSW Steel Limited and JFE Steel Corporation at the end of January for €440mn, ongoing negotiations with potential buyers for the Springs and Stabilizers business unit, a planned JV with EPCG for SE, and a potential minority spinoff of MS. Additionally, the newly installed management team is heavily incentivized to ensure that they take the correct steps to truly crystallize these values and prevent a repeat from a few years back. As such, I believe TKA presents an appealing risk-reward at its current valuation.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial advice. Please do your own research or consult a financial advisor before making any investment decisions.

Very good write up. Bought the shares after reading Ulf´s post, what a timing. Again, great post.

"While the specific figure EPCG paid for the 20% stake has not been disclosed, analysts estimated that the purchase price was in the range of €350mn-€400mn" do you have the source for this?